kern county property tax due

10 according to a press release from Jordan Kaufman the countys treasurer and tax collector. Visit Treasurer-Tax Collectors site.

New Homes For Sale In Rosamond California Your Dream New Home In Rosamond 3 Broker Co Op 3 Exci New Home Builders California Modern New Homes For Sale

First installment payment deadline.

. If the due date falls on a Saturday Sunday or. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. Please select your browser below to view instructions.

Cookies need to be enabled to alert you of status changes on this website. Property taxes in Kern County are due semi-annually on November 1st and February 1st of each year. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year.

Mar 29 2022 1108 AM PDT. If any of these payment or filing deadlines fall on a weekend or. Kern County collects on average 08 of a propertys assessed fair market.

Reduce property taxes for yourself or others as a legitimate home business. If any of these payment or filing deadlines fall on a weekend or. Dec 8 2021.

If the delinquent date falls on a. Share Bookmark Share Bookmark Press Enter to show all options press Tab go to next option. Kern County real property taxes are due by 5 pm.

Property tax delinquency notices for Kern County were mailed May 25 and are due on or before June 30 the Kern County Treasurers office said. Taxes that are unpaid by December 10th and April 10th. You can call the Kern County Tax Assessors Office for assistance at 661-868-3485.

Ad Reduce property taxes 4 residential retail businesses - profitable side business hustle. PAYMENT OF TAXES DUE DATES Taxes become a lien on all real property on the first day of January at 1201 AM. KGET If you have paid the first installment of your property tax your second installment is due in just a few.

The first installment becomes due and payable on November. Search Kern County Records Online - Results In Minutes. Secured tax bills are paid in two installments.

KGET The Kern County Treasurer and Tax Collector KCTTC is reminding Kern residents that the first installment of property tax is due next week. Kern County CA Home Menu. Ad Find Kern County Online Property Taxes Info From 2022.

Taxes are due November 1st and Feburary 1st and will become delinquent on December 10th and April 10th at 5 oclock PM. First installment is due. Add to my Calendar.

The first installment is due on 1st. Property Land and Taxes. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Kern County CA Home Menu. A 10 penalty is added as. Last day to pay second installment of regular property taxes secured bill without penalty.

Please enable cookies for this site. Payment of Property Taxes is handled by. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100.

Treasurer-Tax Collector mails out original secured property tax bills.

New Homes For Sale In The Inland Empire California Buy Your New Home At Frontier Communities Brokers Welcome New Homes For Sale The Neighbourhood Hometown

How To Find Tax Delinquent Properties In Your Area Rethority

California Property Tax Calendar Tax Deadlines

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

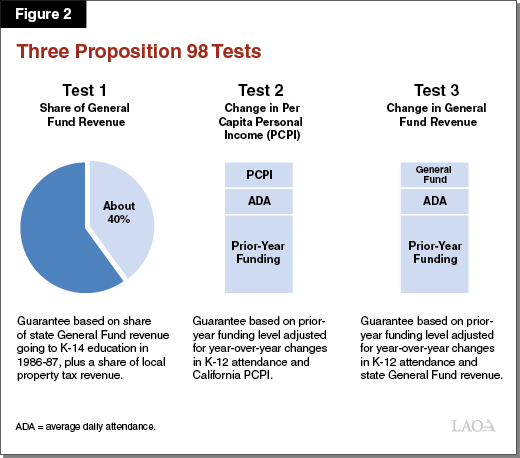

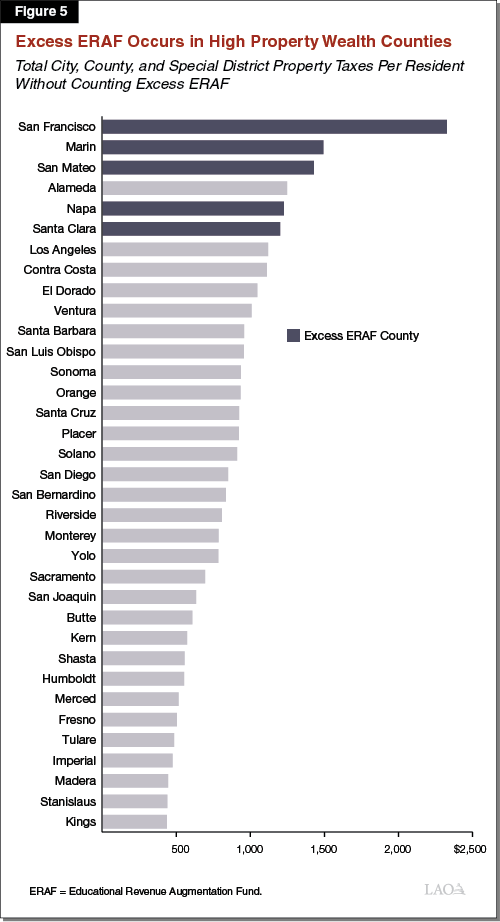

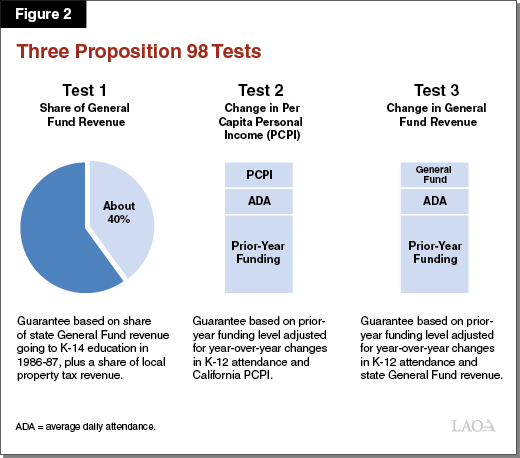

Excess Eraf A Review Of The Calculations Affecting School Funding

California Public Records Public Records California Public

Kern County Treasurer And Tax Collector

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Pin By Sandy Gillespie On Carolinas Estate Tax Government York County

Kern County Treasurer And Tax Collector

Excess Eraf A Review Of The Calculations Affecting School Funding

City Approves Balanced 33 3 Million Budget News Tehachapinews Com

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

Retirement Planning Spreadsheet Track Investments Spreadsheet Template Budget Spreadsheet

How To Find Tax Delinquent Properties In Your Area Rethority